The International Monetary Fund (IMF) has been forced to significantly revise its official economic forecasts from January following Donald Trump's trade war, with almost universal cuts in the main economies except for Spain and Russia.

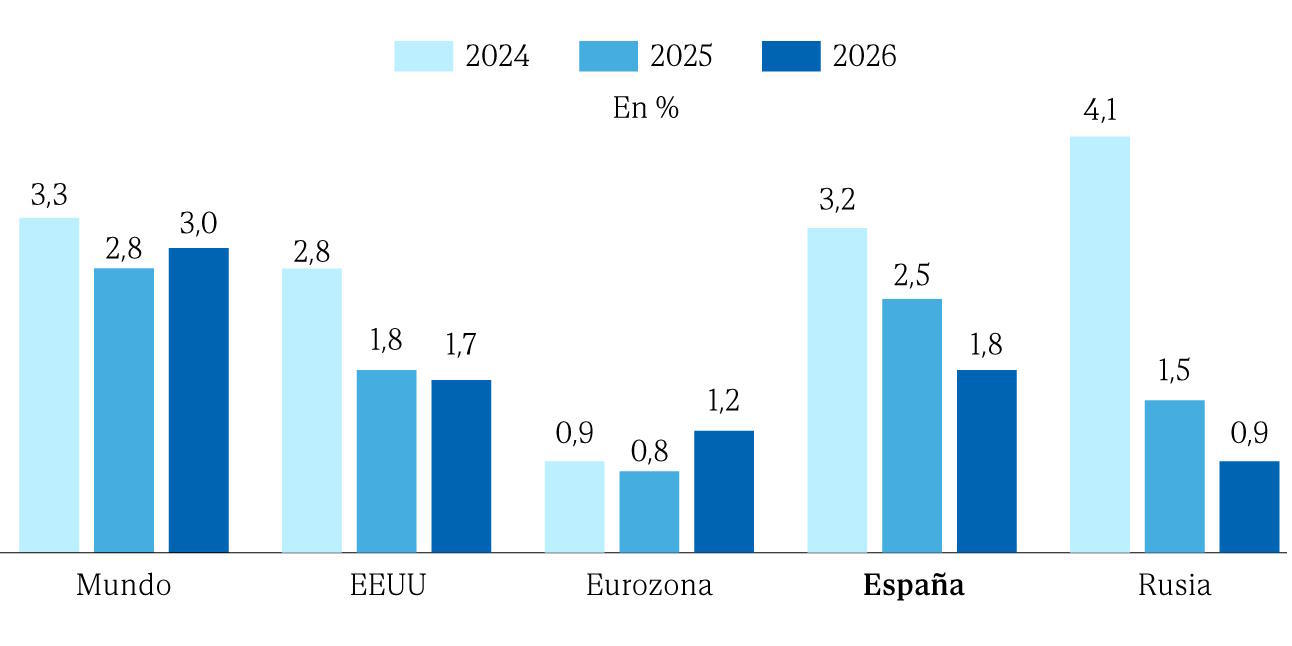

The IMF cuts global growth by five tenths, which will be just 2.8% in 2025, well below the pre-pandemic average of 3.7% annually in this century.

Among the hardest hit is the US economy itself, which loses nine tenths since Trump took office. It will not enter a recession but will grow below 2% (1.8% and 1.7% in 2025 and 2026) compared to the robust 2.8% in 2024. This is one of the IMF's largest downward revisions since January, but its southern neighbor will suffer more. Mexico will enter a recession - the only major economy expected to enter negative territory - with a three-tenths decrease, resulting in a 1.7% loss compared to the early-year estimate.

The IMF's Chief Economist, Pierre-Olivier Gourinchas, justifies the changes, stating, "We anticipate that the sharp increase in tariffs and the uncertainty unleashed on April 2 [Trump's tariff announcement] will cause a significant slowdown in global growth in the short term."

The French economist emphasizes that this is their "baseline scenario," but there could be different paths depending on how the trade war unfolds, which he describes as "unpredictable" and "the varied impact of tariffs on different countries through a diverse set of channels."

For now, "the common denominator is that tariffs represent a negative disruption to the supply for the economy imposing them, as resources are reallocated towards the production of non-competitive goods, leading to a loss of aggregate productivity, reduced activity, and higher production costs and prices."

Another negative effect for the US is that "furthermore, in the medium term, by reducing competition, tariffs increase the market power of domestic producers, reduce incentives for innovation, and create multiple opportunities for rent-seeking."

And for its trading partners? "Tariffs primarily disrupt external demand, driving foreign customers away from their products, although some countries may benefit from redirected trade flows. These effects are magnified in the presence of modern and complex global supply chains," Gourinchas highlights.

China's economy will also suffer and grow at most by 4% this year and the next, which is five to six tenths less than previously forecasted.

As for the Eurozone, it will grow by 0.8% and 1.2% this year and the next after a downward revision of two tenths for each year. Germany will have zero growth this year but is expected to approach 1% in 2026. The economies of France (0.6% in 2025) and Italy (0.4%) will also lose momentum due to the trade war.

Spain once again stands out among the major eurozone economies, growing by 3.2% in 2024 and surpassing Germany, France, and Italy, among others. The IMF raises its growth forecast by two tenths for 2025, placing it at 2.5% and solidifying its position as an economic star in the Eurozone.

For 2026, the IMF maintains its early-year estimate of 1.8%. Both figures fall below the 2.6% and 2.2% officially projected by the Spanish government.

According to the IMF report, "manufacturing activity has remained weak due to the persistent rise in energy prices, while services have been the main driver of growth, contributing to the divergence among European countries, especially those more dependent on these sectors, notably Germany versus Spain."

Regarding the Spanish economy, it points out that the upward revision "reflects a carry-over effect from better-than-expected results in 2024 and reconstruction activity following the floods."

As for Russia, the IMF raises its forecast by one tenth, projecting a 1.5% growth in 2025. It will no longer grow at 4.1% as in 2024 during the Ukraine invasion and theoretical scenario of sanctions, but it will perform slightly better than expected, according to the Fund.