The unwanted side effect in medicine is any response of a drug other than its main therapeutic purpose. They are not always negative adverse reactions. In economics, they are called externalities and occur when the impact of an activity affects third parties not involved in that activity. The GLP-1 drug family, the famous and award-winning Ozempic, Wegoby, and Mounjaro, have experienced both.

Some analysts argue that while some focus on how ChatGPT will change the world, so will the GLP initials. These respond to molecules based on the imitation of the peptide-1 similar to glucagon, which we already have in the body. It is secreted in the intestine and sends signals to the brain and the rest of the digestive tract indicating that food has arrived and that no more needs to be eaten.

The drugs, designed to combat diabetes, are also useful against obesity and cardiometabolic problems, followed by a long list of neurological side effects, still in the validation phase. While the first economic effect was their price (exceeding 200 euros monthly in the EU, 1,000 in the US), the lifestyle changes they provoke already have a direct impact on key consumer sectors such as food, leisure, fashion, and health insurance.

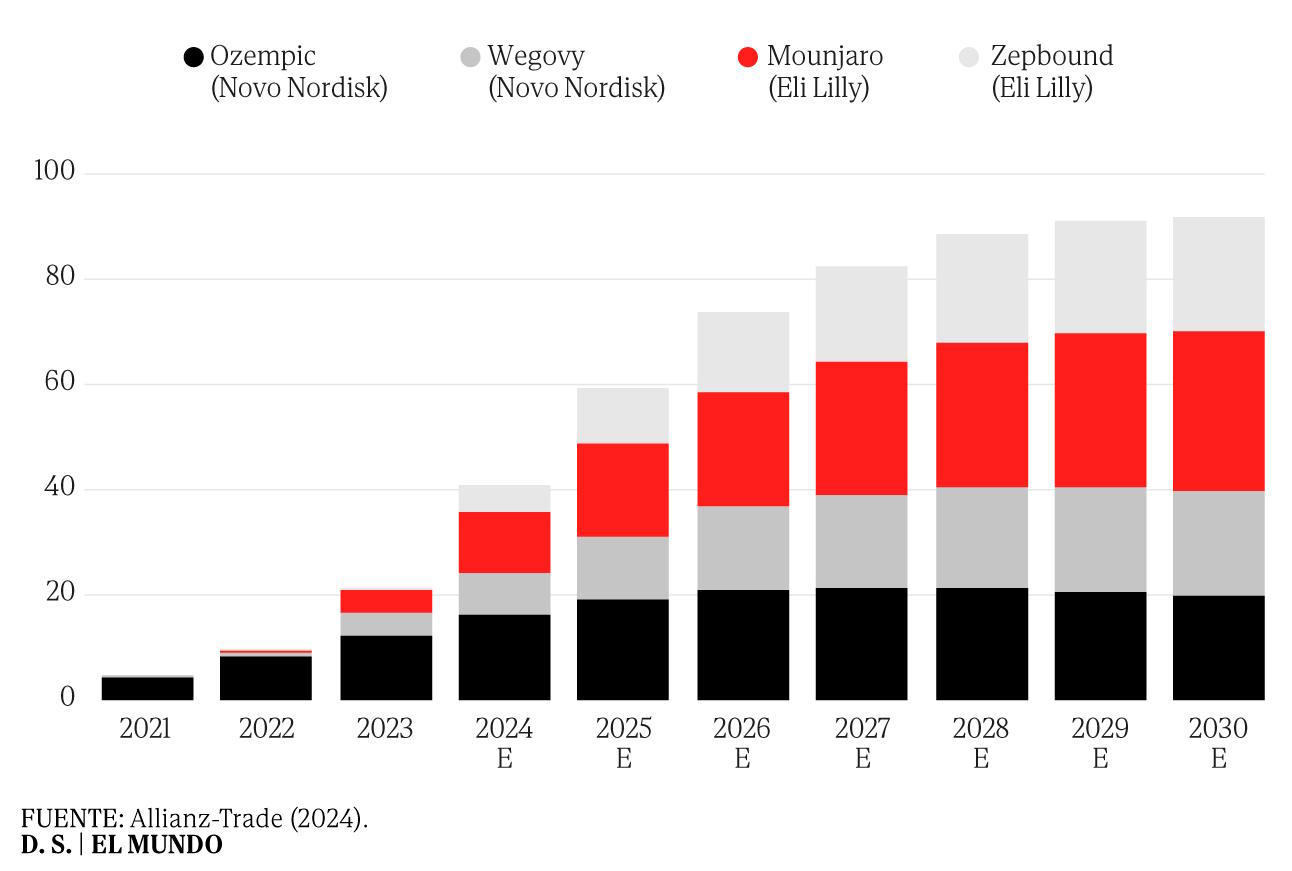

Impacts that, with or without tariffs, were already looming, so many were already doing their short and medium-term calculations and forecasts. Tariffs in this case are key. The main laboratory is Novo Nordisk, a Danish company that currently almost sustains its country's economy: one out of every 10 products imported comes from its factory and contributes over 9,000 million Danish crowns to public coffers through corporate taxes. Its main competitor is the American Eli Lilly. The Indianapolis pharmaceutical company reported sales of Zepbound and Mounjaro at the beginning of 2025 of 1,910 million dollars and 3,530 million dollars respectively, according to Reuters. Together, they went from billing around 4,500 million euros in 2021 to 21,200 million in 2023.

Globally, obesity is a silent pandemic affecting one in eight people worldwide. According to The Lancet's forecasts, by 2050, six out of ten adults and a third of children and adolescents will be affected. The US is one of the countries where the problem is most visible: 45% are obese and 70% are overweight.

It was there where the boom of these drugs occurred. The side effects of the antidiabetic Ozempic became famous thanks to the star system led, among others, by Elon Musk, and have helped to reduce obesity rates by 2% in the US population between 2020 and 2023. In that year, a study by JP Morgan made the first predictions: the number of user-patients would reach 30 million, 9% of the total population, by 2030. By then, they already noted that 77% of them ate out less, as a result of decreased appetite.

According to María Latorre, Head of Business Research and sector advisor at Allianz Trade, "the food sector could feel the impact more, especially in the US". This consultancy has quantified this impact by areas with ten-year forecasts. "In 2023, it is estimated that 500,000 people consumed one of these drugs in the US, and it is estimated that it could reach up to 15 million American adults by 2030. Therefore, the food industry could experience a decrease in demand for ultra-processed and high-calorie products, while fashion could see a shift in clothing demand due to the weight loss many users experience."

Weight loss is significant, and its impact on the economy is also significant. Clinical studies point to reductions of up to 25% in body weight, a figure expected to be exceeded with the new generations of GLP-1 still in trial phase. Economic analyses indicate a dent in the snack market growth of up to $12 billion in the next 10 years, according to EY-Partenon. A study by the Cornell University and Numerator quantified the reduction in the shopping basket by $416 per household per year, six months after starting the treatment.

New lifestyles, new consumption norms. Manel Peiró, Associate Professor in the Department of People and Organization Management at Esade, points out that in the current scenario of uncertainty generated by the "tariff war," what does "certain rationality" are the changes generated by these anti-obesity drugs. "The analyses already point it out, since the US is the paradise of fast food. Those who notice the positive effects do not want to go back, and they prioritize vegetables, fresh fruits," explains the director of the Executive Master in Healthcare Organizations Management at Esade.

This perception has been quantified. In a comprehensive analysis by Morgan Stanley, it was noted that the increase in fruit and vegetable consumption in these individuals amounted to 46% compared to a 66% decrease in processed foods. It is important to emphasize that the magic attributed to these drugs, their effectiveness, is only such if accompanied by a change in lifestyle: a healthy and balanced diet and exercise, all sustained over time. With this formula, it is reasonable to expect visible and lasting economic impacts.

In the short term, there are sectors that are already seeing the effects, as explained by Francisco Rodríguez Fernández, Economics professor at the University of Granada (UGR) and senior economist at Funcas, such as "food and beverages, where there is a clear reduction in calorie-dense and processed products." "But even in fashion, there is an increase in smaller sizes due to significant weight loss." There are quantified analyses on this: sales of large women's shirts dropped by 11% between 2022 and 2024, while smaller sizes grew by 12%. Additionally, the clothing rental company Rent the Runway has noted that the use of smaller sizes has not been seen in the past 15 years. Alcohol and soft drinks are also affected: their consumption rates dropped by 62% and 65%, respectively, according to Morgan Stanley.

Rodríguez warns that, although the focus is currently on the US, its adoption in Europe and Spain is growing. "The GLP-1 market is expected to reach $3.49 billion in 2024 and grow at an annual compound rate of 5.90% during the projected period." Peiró has doubts about whether Europe will see the same significant impacts as those on the other side of the Atlantic. "We do not have the same disease levels, and our eating patterns are different. But let's not forget that there are other effects on addictions, such as alcohol. With the approval of these indications, there will be impacts," comments the Esade professor. "The tobacco industry still exists, right? Smoking has decreased, but not disappeared," he adds.

Similar to tobacco, the processed food industry will adapt. Against the rejection of calorie-dense products high in salt and sugar, other products with more desirable ingredients, such as proteins, will be offered. This element has seen a 65% increase in these patients' diets. Brands like Nestlé or Herbalife already have products tailored to GLP-1 users.

Obesity has economic consequences beyond cancer or heart diseases, among others. The economic impact of the problem is evident, with states accumulating ¤698 billion annually in direct costs, representing 7.7% of global healthcare spending (expected to reach 9.7% by 2035), not to mention the loss of productivity. In OECD countries, 3.3% of GDP is spent on obesity, and the active population in its 52 member states decreases by the equivalent of 54 million full-time workers.

The widespread use of GLP-1 could save two trillion euros in healthcare costs over the next decade if obesity rates stabilize, or 3.3 trillion if they revert to 2010 levels, according to Allianz Trade. In the US, where the burden is higher, this figure could reach between 1 and 1.8 trillion euros.

Latorre focuses on the insurance sector, "as they may need to adjust their policies." He elaborates on the warning: "These drugs can reduce the prevalence of obesity-related diseases and type 2 diabetes, altering long-term healthcare costs." Allianz Trade emphasizes that this change will not be immediate, "structural adaptations will be gradually seen," and its magnitude is associated with "access to these medications (including affordable prices), their proven long-term effectiveness (still under study), and whether the population intentionally adopts healthier habits."

But who pays for the medications?

One of the obstacles is their price until a generic formula arrives. And there is still time; for example, the patent loss for Ozempic is expected in 2031. Later for new generations, like Mounjaro or Wegoby. A monthly treatment can cost up to $1,000. This cost falls on the patient or on the state's budget depending on the provider, whether private or public healthcare.

Goldman Sachs estimates that the global GLP-1 market could reach $100 billion by 2030, as cost and supply restrictions decrease and insurance coverage expands. In the US, it depends on Medicare and Medicaid coverage, if the Trump administration continues Biden's legacy of including these drugs and considers obesity a chronic disease, this could mean an additional cost of up to $35 billion by 2034, according to the Congressional Budget Office.

For Peiró, the obstacle also lies in short-term spending perspectives. "Both insurance companies and public healthcare [here in Spain] are conditioned by year-end closures in their decisions." The Esade professor argues that "changing mentality is challenging: if a treatment is effective and reduces illness, investment should be made in it. But the focus is on today's cost, not tomorrow's." An example supporting this spending is seen in hepatitis C treatments: "This condition led to failure, transplants, and in the worst cases, death. The decision was made to invest in them. Lives were saved, and those on sick leave became productive members of society."

The UGR Economics professor argues that "the cost of medications could balance the savings". He also points out that "in 2024, the US Congress demanded Novo Nordisk to reduce prices and highlighted the difference between the US and other countries." In the current geopolitical context, these nuances are crucial. "The Danish company has been one of the main drivers of GLP-1 treatments, and its success in the US could have implications, with Novo Nordisk being a key player in the American healthcare market," states Latorre.

In the first announcement on tariffs, Trump stated that "pharmaceutical companies will return strongly" to producing in the US, "suggesting that import tariffs are still on the table," as interpreted by Allianz Trade. Eli Lilly announced plans to invest in new plants in the US.

Novo Nordisk has its US headquarters in Plainsboro and has expansion plans due to Europe's discouragement of the pharmaceutical industry. In Boston, around $4 billion is allocated to place the Global Business Development R&D department in Cambridge. At the end of last year, it invested ¤10.659 billion in three Catalent factories. This would fulfill the requirements imposed by Trump.