In times of high volatility, investors seek safe-haven assets, such as gold, but also strategic or defensive sectors. Within this category are companies that are not as exposed to economic cycles, both for good (because they will not be as affected by volatility) and for bad (their profitability is more long-term oriented). In summary, the first characteristic to identify such a sector is the society's dependence on its goods or services, with two clear examples: food and health.

Health was among the strategies and forecasts for 2025 from various management firms, as it globally shows solid growth trends. "Historically, the healthcare sector has outperformed other sectors during recession periods, as health demand is inelastic: regardless of the economic cycle, it will always be needed," explain Renta 4. In addition to defending an unalterable demand for products and services, their analysts emphasize the development of specific solutions for the progressive aging of the population (inevitable), and advances in R&D in biotechnology, new pharmaceutical production, and personalized medicine services. "Areas such as telemedicine and artificial intelligence applied to medical diagnosis have experienced exponential growth" in recent years, experts point out.

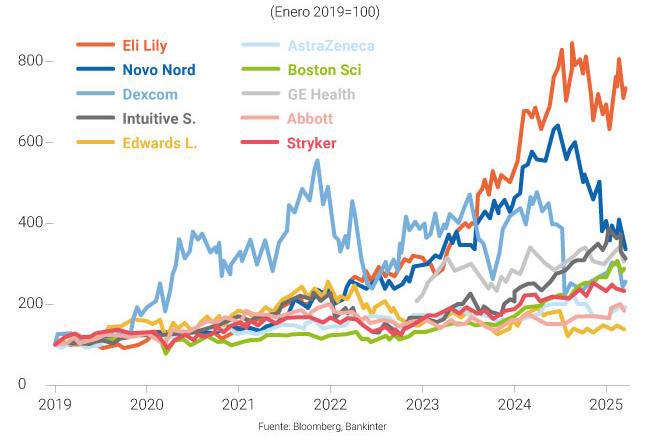

However, during March, some benchmark companies experienced significant losses in their stock prices, such as the Norwegian Novo Nordisk (-27%), the American Dexcom (-22%), or the British AstraZeneca (-5.9%). These critical days have also affected benchmark indices in the healthcare investment sector, such as the MSCI World Health Care (-2.32%).

Entities like Bankinter, which focus on the technological development of medicine, warned about this "poor performance in March, due to uncertainties in the US," after which they recommended "adopting a cautious approach." In their case, their Health Technology Thematic Portfolio has declined by 8.9% between March 1 and 27 and is in losses, dropping by 5.4% in 2025. Their analysts warn that "in this environment, the uncertainties surrounding the sector outweigh the attractions, and we do not see short-term catalysts pointing to a possible improvement to offset the recent poor performance of these companies in the stock market."

One element that has jeopardized the growth of the healthcare sector is Donald Trump. In addition to being targeted in the trade war, like other industries, there has also been a reduction in federal subsidies for certain pathologies, the suspension of public health programs such as USAID, and the US withdrawal from the WHO. As Borja Sangrador, EY's responsible partner for Health & Life Sciences, explains, these disruptions will be "especially relevant" for those players without headquarters or manufacturing in the US.

Especially under scrutiny is the American sector: according to Bankinter experts, the US presence in the healthcare sector (globally) is the most representative, with an 85% weight, compared to 10% for Japanese companies and 5% for European ones.

So, is healthcare sector investment in danger?

Trump recently announced tariffs on imports of, for example, drugs, which has scared off investors. As Ignasi Viladesau, MyInvestor's Chief Investment Officer, explains, the pharmaceutical products sector represents 40% of the healthcare sector, making it the heaviest among all options. Tariff trade policy can affect certain companies that have structured their production chain to minimize tax payments, such as those based in Ireland, a country that offers various tax advantages to pharmaceutical companies. This announcement "caught the market somewhat by surprise," Viladesau expresses, as there were no comments on this during Trump's campaign. The expert, however, sees a "highly unlikely" exaggerated contraction in US medical demand, and maintains his bet on medicine as a strategic sector. "It is the country that spends the most on health worldwide. Putting a tariff and slightly raising the drug price will not stop pharmaceutical spending in the US. On paper, a very high tariff could curb demand, but the reality is that healthcare spending in the country is significant and will not change: 'It will continue to spend a lot on health.' This is also a long-term trend everywhere: we are living longer. 'And government health programs only cover seniors. And that part of the population will increase,'" he explains.

"Historically, it is a much more resilient sector than the rest of the stock market. It represents about 10% of the global stock market: it is not the largest sector, there are much larger ones, such as technology or finance. But it has a certain weight," he points out. "Being also a quite defensive sector, last year, when the stock market rose by more than 20%, the healthcare sector remained below 10%. That is, this works on both sides: when the market goes down, the healthcare sector tends to drop less, when the market rises a lot, it tends to rise less," he concludes.

However, the healthcare sector is not immune to expectation adjustments, as has been the case with weight loss medication companies. "These companies rose significantly, and now they have deflated a bit," Viladesau points out. Therefore, MyInvestor advocates diversification to avoid concentration in a few companies, which may be more susceptible to market volatility. Among the firm's strategies are ETFs (exchange-traded funds) that replicate health MSCI indices and encompass various companies from Europe, the United States, and globally (World).

Viladesau emphasizes the good prospects and performance of the sector this year, surpassing occasional bumps resulting from geopolitical tensions but sustained by the progressive aging population requiring new solutions and services. In this regard, the expert highlights opportunities that may arise in sectors directly focused on the aging population, such as biotechnology, where significant development is expected in the coming years.

The technological development of medicine is one of the pillars supporting the current investment focus on the sector, despite the negative impact of Trump administration decisions on technology, extending to pharmaceuticals. However, Bankinter remains firm, although they acknowledge they have "slowed down a bit" in their healthcare recommendations. Above all, Pedro Echeguren, financial analyst at Farma & Salud in Bankinter, emphasizes that healthcare is a sector where profitability comes in the long term. A compound annual growth rate of 43% is estimated for the global AI healthcare market for the period 2024 to 2032. The expert notes that Trump's tariff threats are aimed at the recovery of American pharmaceutical and technology companies that sought refuge in Ireland for better tax conditions.

In this newly initiated negotiation process, the key will be which country provides more advantages, and in that sense, as Echeguren points out, making predictions is difficult. "Caution must be exercised, but without fear. Controlling risks should be the priority, at least until summer," say Bankinter, which does not withdraw its bet on medtech. "It is a differentiated sector within medicine. It deviates a bit from the traditional format, which develops, researches, manufactures, and distributes or markets, because this is a component with much more technology, with its R&D. And, in addition, it addresses medical needs with less competition than in more common areas. In general, they are very innovative products," explains Echeguren. Within their portfolio options, he highlights four pillars, always from an R&D perspective: oncology, robotics, diagnostic systems, and non-invasive surgery. They also include some firms involved in developing medication for weight loss control that have recently attracted media attention. He mentions examples like NovoNordisk and Eli Lilly. "They had their moment in the spotlight last year, and upon returning from summer, they started to falter a bit, but we still see potential in this and especially in what comes from the new generation of drugs they are currently developing," he explains. Eli Lilly, the world's second-largest insulin manufacturer, which saw a 64% appreciation in 2021, accumulated a 32% growth in 2024.

However, the expert emphasizes that when investing, even in defensive sectors, it is essential to consider the investor's profile: "For more conservative investors, we like large global pharmacies, with moderate growth and little result volatility," he assesses before pointing out that those seeking higher returns should focus on healthcare technology.

Renta4 highlights recommendations for companies like Intuitive Surgical (specialized in robotic surgery), Boston Scientific (electrophysiology), and Vertex Pharmaceuticals (cystic fibrosis) that they include in their own fund, the Renta 4 Megatrends Health FI. "It has accumulated a return of +26.40% since its launch in 2020 and has outperformed the MSCI World Healthcare in the early part of this year," they argue in favor of a diversified strategy among medical technology, pharmaceuticals, insurers, biotechnology, and healthcare services.