Since his return to the White House in January 2025, Donald Trump has reignited the trade war, plunging global trade into a climate of uncertainty. With contradictory announcements and constant changes in tariff implementation, his administration has created an unprecedented scenario of instability.

The latest blow came last Wednesday when Trump announced from the Oval Office a 25% tariff on all cars manufactured outside the US. The measure will take effect on April 2, a date the president has dubbed "the day of liberation" and on which reciprocal tariffs are expected to be announced against any country that imposes restrictions on the US.

This new tariff is part of a broader trade offensive that not only affects specific countries but raises tensions on a multiregional level. In addition to the 25% tariff on steel and aluminum, in effect since mid-March, an indirect 25% tariff has been announced on all goods imported into the United States from any country that purchases Venezuelan oil. This measure, along with the automotive tariff, amplifies the impact beyond the directly involved countries, such as China, Mexico, and Canada, affecting multiple regions globally and increasing uncertainty in international markets.

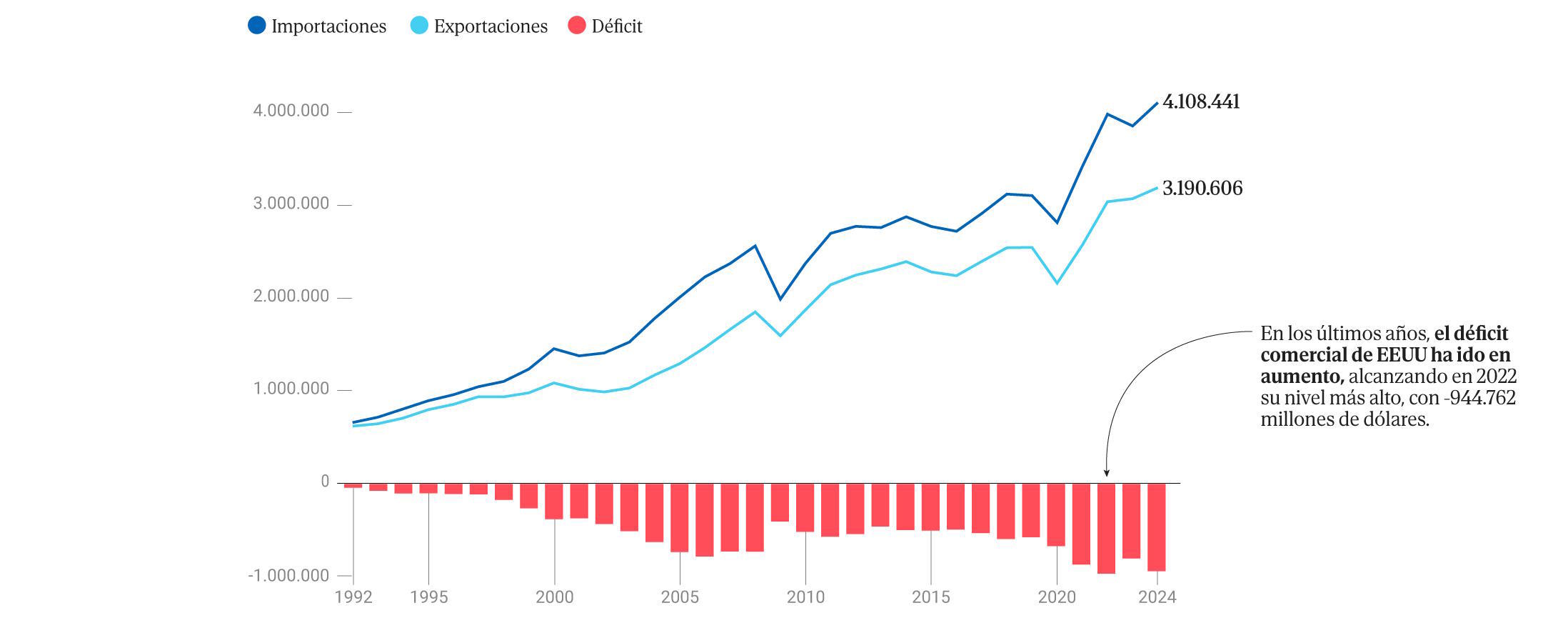

The Trump administration justifies these measures as part of its strategy to reduce the trade deficit of the United States. For decades, the country has imported more than it exports, resulting in a negative balance in its trade account. With these tariff barriers, the White House aims to encourage domestic production and discourage the purchase of foreign goods, although the real impact of these policies remains uncertain.

The US economy relies heavily on imports to supply its domestic market. Its main trading partners reflect global interconnectedness: Mexico (15.3%), China (14.7%), and Canada (13.8%) top the list, followed by Germany, Japan, and South Korea. These countries supply essential goods, from manufactured products to strategic raw materials.

Among the most imported products by the US are automobiles (6.94%), reflecting the strong demand for foreign vehicles, mainly from Japanese and European manufacturers, which Trump aims to curb with the new tariff. Crude oil (5.68%) and refined oil (2.29%) underscore its energy dependence. Additionally, sectors like technology and healthcare play a crucial role in external purchases, with transmission equipment (3.89%), computers (3.10%), and packaged medicines (2.76%) among the most acquired items.

THE THREE COUNTRIES IN THE FOCUS OF THE TRADE WAR

Since January, Washington has imposed an additional 10% tariff on all Chinese products, which was doubled to 20% on March 3. Simultaneously, Mexico and Canada have been hit with 25% tariffs on goods that do not comply with the provisions of the United States-Mexico-Canada Agreement (USMCA).

This trade agreement, in effect since 2020, establishes stricter rules of origin, particularly in the automotive industry, requiring a higher percentage of regionally manufactured components. It also facilitates the access of agricultural products among the three countries. However, starting on April 2, the Trump administration could extend this 25% tariff to all Mexican and Canadian exports, including those previously exempt under the agreement. The measure has sparked strong criticism and threats of commercial retaliation from the affected governments.

Faced with this escalation, the affected countries have responded with retaliatory measures targeting key sectors of the US economy. China has imposed tariffs of 15% on various US products such as chicken, wheat, corn, cotton products, and 10% on sorghum, soybeans, pork, beef, seafood, fruits, vegetables, and dairy products. Meanwhile, Canada has reacted with 25% levies on around 60 billion Canadian dollars of US imports.

The Trump administration's measures have not only affected specific countries but also strategic products in global trade, such as steel and aluminum. These raw materials are essential for industries like construction, automotive, and technology.

The main argument behind these measures has been the need to protect domestic production and reduce dependence on foreign steel and aluminum, essential materials for the manufacturing of weaponry and military infrastructure. Additionally, the US government seeks to curb what it considers unfair trade practices, such as oversupply and dumping by some exporting countries. As a result, the US imposed a 25% tariff on steel and aluminum, impacting major suppliers like Canada, Mexico, the European Union, China, Brazil, and South Korea.

On March 24, Washington announced that, starting on April 2, 2025, it could impose a 25% tariff on all goods imported into the United States from any country that purchases Venezuelan oil, directly or through third parties. China would be the main affected party, as in 2023, it imported 68% of Venezuelan crude. However, Spain would also be severely affected, as per the International Energy Agency (IEA), it was the third-largest importer of Venezuelan oil, with 4%, tying with Cuba.

This measure is compounded by the latest announcement of a 25% tariff on cars and automobile parts manufactured outside the US. The tariff will apply to imports of passenger vehicles (sedans, SUVs, crossovers, minivans, cargo vans) and light trucks, as well as key parts (engines, transmissions, propulsion system parts, and electrical components). This measure mainly affects countries like Mexico (36.9%), South Korea (19.1%), and Japan (17.2%), which led vehicle exports to the US last year. Additionally, Germany is the hardest hit in the European Union as in 2024, it sent 5.6% of vehicles and 5.1% of automobile parts to the US, according to data from the US Department of Commerce.

Before the latest blow to the automotive industry, on March 12, the European Union responded to the US steel and aluminum tariff offensive with a retaliation package valued at 26 billion euros, to be implemented in two phases. The first, worth 8 billion, would take effect on April 2 and target emblematic US products like bourbon, Levi's jeans, and Harley-Davidson motorcycles. The second phase, adding an additional 18 billion, was scheduled for mid-month after consultations with member states and stakeholders.

In response to these measures, Donald Trump reacted with a direct threat: imposing tariffs of up to 200% on "all wines, champagnes, and alcoholic products from France and other EU countries" if Brussels did not immediately remove the 50% tariff on US whiskey.

However, on March 20, the President of the European Commission, Ursula von der Leyen, announced the postponement of the planned retaliatory measures for April 2, delaying them until mid-April to open a new negotiation path with the White House before the measures take effect. Nevertheless, Trump's recent announcement on automobile tariffs could once again precipitate the EU's response.

Now, all eyes are on April 2, the date when Donald Trump could impose new reciprocal tariffs, further intensifying pressure on the US's main trading partners and exacerbating economic frictions globally. Key sectors like pharmaceuticals, manufacturing, automotive, and agriculture are at the center of this dispute, facing the risk of severe economic consequences if the situation continues to deteriorate. Meanwhile, financial markets respond with volatility to the possibility of new tariffs and trade restrictions, reinforcing the sense of global instability and casting doubt on the future of trade relations among the world's major powers.