Investing in major markets (United States, Europe) usually has well-mapped routes. However, the trade war initiated by Donald Trump has cast uncertainty over the horizon, leading the more adventurous investors to seek new opportunities. In this context, analysts have detected a "relatively recent" appetite among investors towards lesser-known economies, either to shield themselves from the turbulence of the trade war or simply to avoid being constantly targeted by the U.S. president.

The term emerging economies was created to encompass countries experiencing rapid economic growth, thus having a large consumer market, potentially high GDP rates, and developing their own industries.

In virtuous cycles, they are like rough diamonds. However, all good things come at a price, and in this case, it is the high level of risk posed by economies with significant institutional weakness and severe exposure to currency devaluations. According to S&P Global, in their latest valuation report, while the profitability in emerging markets from all regions has been solid since the beginning of the year, the current international situation places them in a delicate balance. A probable appreciation of the dollar in 2025 and the evolution of the stock market will be key to monitor financial markets, as "disappointing trends can lead to capital outflows."

"In our view, the additional uncertainty in external prospects only emphasizes the importance of maintaining an active approach to investing in emerging markets," says Andrew Rymer, senior strategist at the Strategic Research Unit of Schroders, adding that "this asset class is undervalued by foreign investors, but very few major emerging markets show external vulnerabilities that historically have led to market dislocations."

Geopolitical instability and market volatility affect everyone. However, Rymer points out, "Our assumption is that U.S. tariffs will ultimately be less aggressive than threatened," although he warns that it is "too early to know for sure." Nevertheless, he insists on investing in emerging markets based on the fact that, in certain economies, "the discount of emerging market stocks compared to developed ones is near its largest level in 20 years." In other words, it is now cheaper to invest in some of these markets.

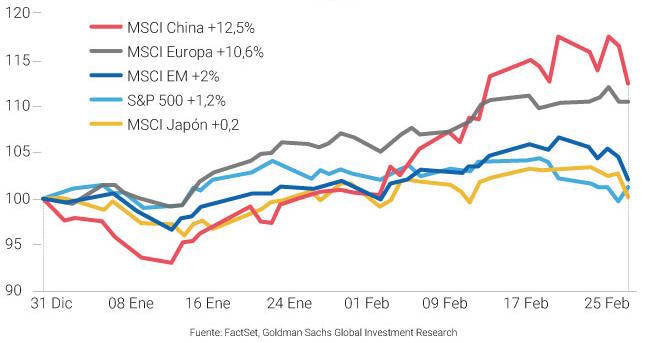

Goldman Sachs focuses, in one of its recent analyses, on the resilience of emerging market currencies over the past month compared to previous months, reflecting, in part, the downward revaluation of U.S. growth compared to the rest of the world and the general weakness of the dollar.

Although it is not a closed club (everything varies depending on its evolution), some examples of emerging economies include China, India, Brazil, Mexico, Colombia, Egypt, Hungary, Colombia, the Philippines, and Thailand.

Allianz Global Investors point out three target countries: Brazil, India, and Turkey, where they find "great investment opportunities," as explained by Carlos Carranza, emerging market debt manager at Allianz Global Investors. "In Brazil, Brazilian bonds trade with an internal rate of return (IRR) of 15%. The Brazilian real has a lot of room for appreciation," explains Carranza, adding that the country has a central bank that is raising interest rates and has anchored its currency, the Brazilian real. Among the reasons to bet on the South American country, Carranza highlights that it is "geographically isolated" from (hot) global political risks, such as frictions with Trump, the invasion of Ukraine, European tension, etc.

Looking at the Asian region, Carranza favors India, "where we believe there is value in any investment in the local currency, the Indian rupee." He relies on the currency's "very low volatility", with a "very strong central bank defending the currency position and a relatively high bond rate." Regarding the latter, Carranza points out that "we see value in 10-year bonds in India because it is an economy growing at almost 8% per year, one of the highest growth rates among all emerging and investable markets." He again emphasizes its isolation from geopolitical conflicts based on "a fairly neutral view on the war in Europe and against the United States. They have not referenced Trump and his administration. They have practically not made references to any conflict."

This isolation of the Asian country is also noted by analysts at Schroders: "In the short term, it makes sense to look at relatively closed large emerging economies, with markets focused on the national level. India is an obvious example of this," explains Ryders.

Both Brazil and India are members of the BRICS (Brazil, Russia, India, China, and South Africa), negatively targeted by Trump a few months ago but now forgotten (and sheltered by the good understanding between the U.S. and Russia). Carranza downplays the American president's comments, pointing out the need for caution when taking "erratic" Trump comments seriously.

Finally, the Allianz expert points to Turkey as a country within the European region with better development prospects, based on a stable political situation. "They are taking orthodox economic measures that in the long term can benefit the population and the country's growth. They also have a high level of bond rates and currency devaluation that is isolated from international event volatility. So, when there is breaking news from Trump and tariffs towards many emerging markets, Turkey remains unaffected." This low volatility is accompanied, according to the expert, by one of the largest disinflation rates in the world: "Turkey is currently reducing its inflation from 60% levels at the end of last year to 30% levels by the end of this year. This means that inflation in Turkey will decrease by 30 percentage points in 2025, a massive disinflation." He attributes this good performance to the "great job of raising interest rates" to anchor inflation and slow down the economy. "An asset that responds to inflation in Turkey is the 10-year bonds in local currency, in Turkish lira; because if inflation decreases, the rate of those bonds should decrease, and therefore, their price should rise."

According to Carranza, the key to investing in emerging markets is the geographical isolation from international conflicts, explaining why countries like Hungary, an emerging economy but sensitive to, for example, the evolution of the German economy and its recent announcement of increased defense spending, are not the most notable.

In terms of investment strategies, Carranza highlights the role of benchmark indices, such as those developed by JP Morgan (Emerging Market Bond Index or EMBI), which are used as a reference in the Allianz Emerging Markets Select Bond, a corporate and government bond investment fund (in local currency) created in 2014 that has accumulated a return of 1.95% so far in 2025. However, JP Morgan's index is not the only benchmark, as the MSCI Emerging Markets (EM) indices developed by Morgan Stanley Capital International in 1988 are also noteworthy, encompassing around 26 countries.

China's direct exposure to tariffs has drawn attention to investing in this economy, despite its strong performance in recent years and growth prospects. In fact, S&P Global explains that there have already been net capital outflows from this market in recent months.

Faced with uncertainty, within the firm AXA Investment Managers with indexed funds to MSCI EM indices, they extend their investment focus to the entire Asian emerging economies, excluding Beijing precisely due to its exposure to Trump's trade war. Their team of analysts defends this ex-China approach, highlighting the importance of commodity production in the Philippines and Russia (two-thirds of global nickel production), as well as the fact that "Korea and Taiwan have benefited from the surge in investment in AI, as sales of their advanced semiconductor manufacturers have driven a strong recovery in technology exports. Although non-tech exports seem to be losing momentum, AI investment will persist in the medium term, benefiting technology manufacturers throughout the region," conclude the experts.