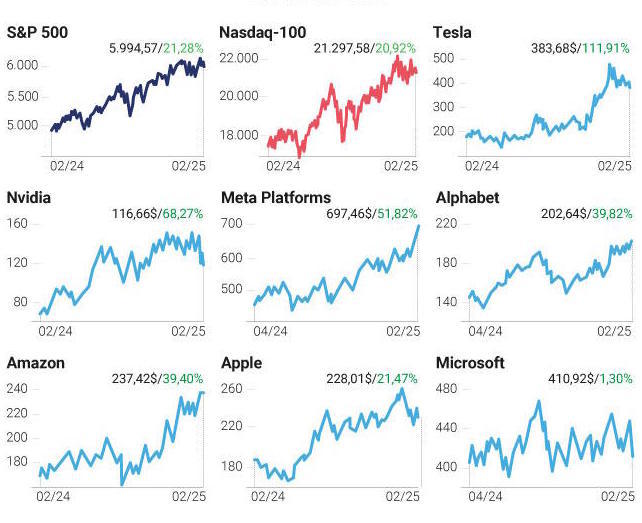

Figures from the past year in the American technology sector further fueled the bet on these companies: the main global stock benchmark, the Standard & Poor's 500 index (better known as S&P 500) encompassing the 500 largest companies in the United States, grew by 23.3% in 2024, a very significant advance for the markets. Among the factors that contributed to this growth, the performance of the big tech companies stood out, especially the so-called Magnificent Seven (Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, and Tesla). Currently, this select club explains around 30% of the index's performance.

Given their stock market weight, it is not unreasonable to conclude that if technology does well, the economy will do great. The figures reflecting the revaluation that the sector experienced last year, or the multimillion-dollar investments made by Donald Trump in the Stargate project, his most ambitious bet on artificial intelligence (AI), have served to prolong, according to analysts, the idea of "unstoppable growth" that has fueled investors' expectations in the tech development, boosted by the AI revolution.

However, if technology falters, the entire market falters. The emergence of Chinese AI from DeepSeek has directly targeted Wall Street's crown jewels with cheaper technology that is still capable of competing with the U.S. Furthermore, the results of some giants, such as Alphabet (Google's parent company), have not met expectations. All of the above has initiated a tortuous path and unleashed the first speculations by analysts on whether the significant investment in AI was justified, or if the time for a pause in this excessive tech euphoria has arrived. Although investors, for now, are not leaning towards moving away from tech companies, they have redirected their appetite towards more discreet sectors but with a notable presence in the markets.

It is a reasonable move. "It is not healthy for the S&P 500 to have seven values, the Magnificent Seven, which have significantly boosted the markets in recent years," explains Natalia Aguirre, Director of Analysis and Strategy at Renta4, who adds that "it is logical to have sector rotation that provides strength to the rises, not only driven by these few values, but by many or most of them."

A reorientation of major investments could lead to the growth and development of other sectors that, although they have not attracted as much attention, have produced good returns over the past year. This would also move away from an excessive concentration in big tech. For those who want to continue investing in the U.S. stock market but not essentially bet on tech assets, there are alternatives that embrace diversification, such as equally weighted indices. These are replicas of the S&P 500, similar to an indexed fund, where the investment is evenly distributed so that it is not concentrated in the largest companies but allocates 20% of the capital to each of them. For example, if the investor has 500 shares, the same proportion of capital is allocated to each value so that the portfolio includes all companies, whether large or small.

"The idea of equal weighting didn't make much sense forty or thirty years ago because there were several decades where the list of the largest U.S. companies was relatively diversified," explains Ignasi Viladesau, Chief Investment Officer at MyInvestor. "If you looked at the largest companies, there was a supermarket, an energy company, a company like IBM, an automotive company... there were many different sectors. Even if it was a bit concentrated in some names like IBM, General Electric, or Walmart, you really had many different sectors. Nowadays, the largest companies are all tech companies," he points out. This brings the investor back to the initial idea: "In the end, if technology does well, the S&P 500 will do well, and if technology does poorly, the S&P 500 will do poorly. That's why we believe that equal weighting is gaining traction." Ultimately, it is a way to protect the investment from the dependence on sectors with more stock market weight.

"At first, the investor thinks that with 500 companies in the index, they can diversify a lot, but that's not what has been observed in recent years when it has been seen that tech companies like Amazon or Google carry a lot of weight," explains Viladesau. "This is because many investors make decisions based on past profitability, and in the end, they end up betting on the most popular companies, and consequently, the investment will return to these," the expert elaborates.

"In the case of tech companies, it is true that they make a lot of money and are doing very well, but with the issue of artificial intelligence, we have reached a point where the prospects are very high," Viladesau points out, clarifying that he does not believe that these companies will do poorly or stop making money, "what is very possible is that these prospects are too inflated and that instead of doubling profits, they will only increase results by 50%. That is already less than what people expect, and this difference between expectation and reality is what makes these values a bit more fragile than those of other sectors."

The majority consensus among analysts is that, in the coming months, there will be an "adjustment of perspectives" on some areas of activity to readjust them to reality, which could, on one hand, slow down the rise in tech stock prices and, on the other hand, improve the prospects of other sectors. "A widespread distancing from tech seems difficult because people have done well, and the AI narrative is appealing," Viladesau opines.

In addition to the delicate situation that the most competitive sectors in the U.S. may find themselves in, analysts warn of another nuance: the markets are in a scenario where it is easy to fall into overreaction. An example of this has been the stock market turmoil caused by Donald Trump's initial decisions at the White House, with one tariff threat after another, triggering nervousness in global stock markets trying to cushion the blow amid cross threats and tense negotiations.

tweets, there are volatility spikes, but one should not make hasty decisions based on his announcements," warns Aguirre, who anticipates that "we are going to experience many moments of volatility with Trump." Like other analysts, she bases a theory on what seems to be the U.S. president's strategy: threatening with measures (such as tariffs) and, after causing global concern, showing willingness to negotiate. "There has not been a persistent increase in volatility because there is not yet an actual trade war," explains Aguirre. However, tension is guaranteed.

So, amidst official announcements, tweets, ups, downs, threats, and negotiations, the key to withstanding volatility remains "having a diversified portfolio, which is what allows to withstand market fluctuations to some extent," Aguirre concludes. Given the numerous market variables, the expert recommends including in investment bets those elements "that always perform well": the dollar, gold, and defensive stocks.

Regarding the precious metal, Aguirre defends its performance in 2024 when its value rose by 27%, reaching historical levels, and she expects this growth to continue in 2025: "So far this year, it has not done badly, up 9%." A "spectacular" growth for which she recommends keeping this safe-haven asset in portfolios because it is "a hedge even against geopolitical risk" and has fundamental support from central banks.

For an investment strategy, Aguirre recommends allocating 45% of the investment to fixed income, especially short-term public debt to avoid risks; dedicating another 50% to investing in equities (stocks), and 5% in liquidity (monetary funds) to take advantage of volatility spikes and buying opportunities.

However, despite the risks and fluctuations, analysts foresee a strong pulse in consumption and investment for 2025. From Arcano Partners, which recently shared its investment forecasts for the new year, they rely on interest rate cuts and inflation control to define their investment outlook as "positive." Among their recommendations, they also include diversifying investments in variable and defensive instruments, such as energy companies, although they do not stray too far from the tech aura when pointing out emerging opportunities in the infrastructure sector, including data processing centers.