Forming a pool with Tesla to offset the CO2 emissions of our fleet is a way to meet the objectives without commercial nonsense, protecting the dealership network. "Because producing fewer non-electric cars is also not the most economical way to do it," said Luca Napolitano, CEO of Lancia and Global Sales and Marketing Director of Stellantis, at the Brussels Motor Show. The statement was related to the well-known CAFE regulation, which this year will require manufacturers to reduce the average CO2 emissions of the cars they sell in the EU27 to 93.6 g/km. And that, they claim, is a herculean effort that they will not be able to achieve given the market conditions. Excluding brands that only sell electric vehicles, almost no manufacturer closed 2024 below 100 grams. In our country, that figure was around 117, and in the Dacia Sandero, the best-selling car in Europe and Spain, the minimum is 105 g/km. Those who do not comply will pay 95 euros per gram of excess and vehicle, which could add up to 15 billion euros in joint fines. Although the industry threatens with a more drastic option: to stop producing two million combustion engine cars, the ones that are most penalized, equivalent to between seven and eight large factories. Something very harmful in Spain, where only 5% of the vehicles manufactured are battery-powered (8.5% are plug-in hybrids). Until November, 190,888 units. A third option would be to increase the price of thermal models to slow down their sales and, at the same time, offset a decrease in the prices of pure electric vehicles, whose demand is much weaker than anticipated. Most experts estimate that, to reach 93.6 grams, their market share should be between 20% and 25%. Until November 2024, it was 13.4% (5.6% in Spain), almost one percentage point lower than in 2023 after a 5.4% drop in sales, according to the ACEA. The key is in Germany, where electric vehicles have been struggling since the end of subsidies in the fall of 2023. In 2024, they decreased by 27% to 381,000 units. This made the United Kingdom, driven by its government's strict requirements, the leading zero-emission market in the Old Continent, with 382,000 units (+21.4%). The problem is that the United Kingdom is not in the EU and does not count towards the CAFE regulation...

A criticism that the Renault Group has extended to CO2 pools: "It would be like feeding the enemy, the Americans, but above all, the Asians." The Swiss consulting firm UBS estimates that Tesla could earn 1 billion euros "if it monetizes its entire position in the sale of rights." Volvo and Polestar, owned by the Chinese Geely, 300 million.

And it would be adding insult to injury. Tesla started its electric adventure almost two decades ago and has been ahead since the Chinese government's shift in favor of this technology, once convinced that they would never be rivals in combustion models. In contrast, Western manufacturers were slow to react, and when they did - with a committed joint investment of 250 billion - they arrived late and poorly. China controls the entire value chain, with the key in materials and battery chemistry. In addition, its brands have been showered with billions in subsidies. The EU says they are illegal and have served to "artificially lower" prices, resulting in additional tariffs (up to 35%) on electric vehicles made in China. On the other hand, Elon Musk's company maintains an aggressive discount policy backed by its enormous financial muscle, and even eroding its margins, markets trust it: its stock value exceeds 1.2 trillion euros, more than all other manufacturers combined. In 2024, it was by far the leader in electric vehicles in the EU, with one out of every seven registrations.

The vicissitudes of Volkswagen, the second best-selling brand in the world, illustrate how tough the decarbonization of this industry is. Ravaged by the very high labor costs in Germany and selling many fewer battery-powered cars than expected, it aims to save 15 billion euros by reducing salaries and capacity in its plants, as well as the "socially responsible" elimination of 35,000 jobs in the country by 2030. In the first nine months of 2024, the German group's operating profits fell by 20.1% to 12.907 billion, and the profit margin stood at 5.4%, when the medium-term target was 8%. Stellantis also halved its first-half profits; Ford announced that it has 4,000 excess employees in Europe, Audi 4,500, and Nissan 9,000 worldwide. These adjustments have reached suppliers, with the halt of several battery gigafactories (Stellantis, Mercedes-Benz, or VW) and with Northvolt, the largest European battery manufacturer, on the brink of bankruptcy. In total, according to the European Association of Automotive Suppliers (CLEPA), unemployment in this sector increased by 30,000 people in 2024, and the net loss of jobs is almost double since 2020 because "the elimination of jobs related to combustion engines far exceeded those created by electrification." Stock performance confirms a future with storm clouds. Except for Tesla, which surged after Trump's victory in November, GM, or Renault - whose CEO complains that capital markets are "unfair" - the rest of the manufacturers have substantially lost value in the last 12 months. The exception is Asian manufacturers and, especially, the Chinese, with BYD at the forefront. Because China has become another major headache for the West. Although there is room for hope.

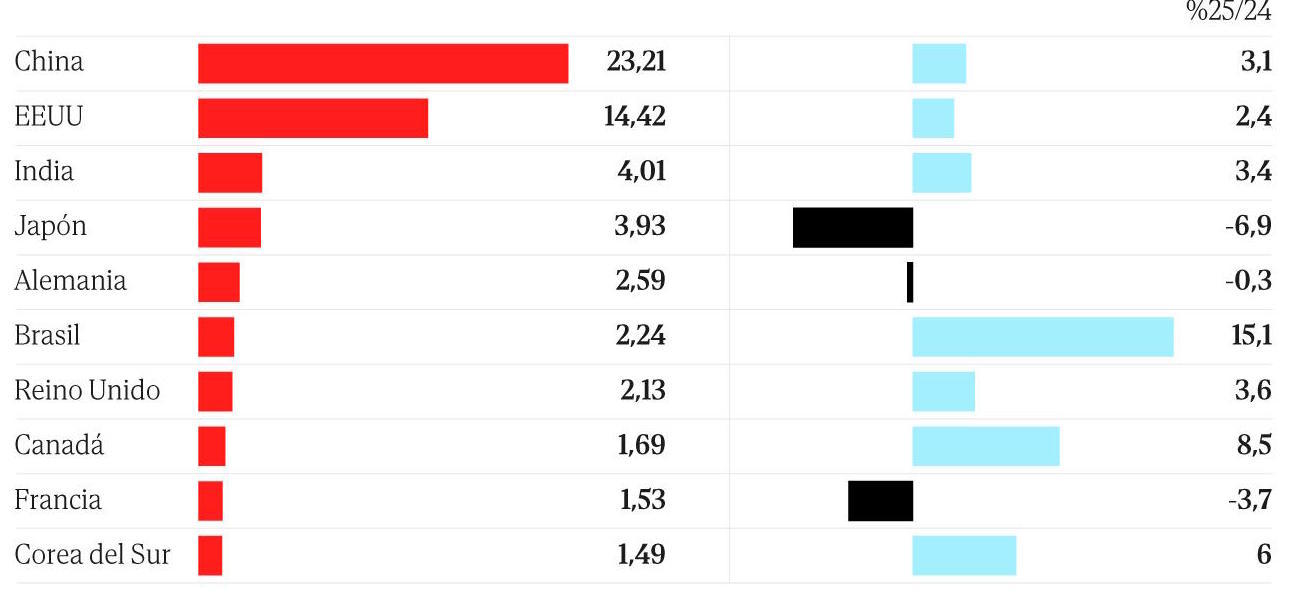

The Asian giant is the world's leading vehicle exporter, with 5.34 million units (+19.3%) between January and November 2024, according to the manufacturers' association CAAM. However, 78.6% (4.2 million) were pure combustion engine cars, and in terms of destinations, Europe bought around 700,000. Russia was its top external market, with 957,000 units, followed by Mexico (386,000) and the United States (261,000). In addition, CAAM predicts that these exports will grow by only 5.8% in 2025. One of the reasons is the tariffs imposed by the EU in October, which until then was its main conquest market due to clientele and facilities, including purchase incentives and legislation. In fact, Chinese imports of 100% battery models decreased by 10.4% in 2024, while plug-in hybrid imports grew by 190%. For many customers in the Old Continent, these vehicles are a more logical alternative towards decarbonization, besides paying extra taxes. However, as it happened with Americans, Japanese, or Koreans, the enemy may be at home: Chery (in Barcelona) and BYD (in Hungary and also considering Turkey) have, or will have, factories in Europe, and MG is still looking for the ideal location, with Spain as a favorite. These will be hundreds of thousands of more expensive cars than if they were made in China but exempt from tariffs.

Because the United States, with a Donald Trump willing to penalize everything not manufactured there, is not a viable alternative, and China has ceased to be the El Dorado of yesteryear, especially for German and premium brands: local brands already have a 67% market share, 20 points more than two years ago, thanks to a significant change in customers. Previously, the wealthiest aspired to a Western car. Today, the technological fever makes them value a national car much more. They even see it as cooler.

BYD is the paradigmatic case: in 2023, it ended nearly two decades of VW's leadership, and in 2024, it sold 3.8 million of the 4.25 million vehicles in its local market, which, with a bit of luck, will catapult it to the third position in the global ranking, only behind Toyota and the German brand. Besides, it is already the leader in plug-in cars and is just 20,000 units away from surpassing Tesla in battery-only vehicles. Added to this is the fierce internal competition in the world's largest market, with 40% of global demand. Toyota or GM have seen how their joint ventures are no longer profitable, and Mary Barra, CEO of the latter, explained it: "Very few are making money there. It is unsustainable, and the number of companies with losses cannot continue indefinitely. But if you enter the type of price war that is currently happening, then you are heading towards the precipice." Part of the solution may be to reverse what happened decades ago: to ally with Chinese manufacturers to share expenses, benefit from their technological superiority, and learn their faster and more efficient methods. This is what Stellantis, Renault, Volkswagen, or Audi have done.